Content

Current assets include cash and cash equivalents, accounts receivable, inventory, and other short-term assets easily converted into cash within a year. The simple and most common way to calculate working capital, also known as net working capital, is to divide current assets by current liabilities. The result is the current ratio, which https://quick-bookkeeping.net/ is a formula often used to gauge the health of a business. The formulae used by these analysts narrow down the definition of net working capital. One of the formulae does not consider cash in the assets, and also excludes debt from liabilities. Another formula only focuses on accounts payable, accounts receivable, and inventory.

- Prior to that, he was an attorney in the Chicago office of Latham & Watkins, and in the Colorado office of Cooley LLP.

- Current assets are available within 12 months; current liabilities are due within 12 months.

- By definition, working capital management entails short-term decisions—generally, relating to the next one-year period—which are “reversible”.

- This happens due to the timely payments you make to your suppliers and banking partners.

- This means the company does not have enough resources in the short-term to pay off its debts, and it must get creative on finding a way to make sure it can pay its short-term bills on time.

If it’s substantially negative, that suggests your business can’t make its upcoming payments and might be in danger of bankruptcy. First, add up all the current assets line items from the balance sheet, including cash and cash equivalents, marketable investments, and accounts receivable. Net working capital can also be used to estimate the ability of a company to grow quickly. If it has substantial cash reserves, it may have enough cash to rapidly scale up the business. Conversely, a tight working capital situation makes it quite unlikely that a business has the financial means to accelerate its rate of growth.

Cash and Cash Equivalents

Working capital is important because it is necessary for businesses to remain solvent. In theory, a business could become bankrupt even if it is profitable. After all, a business cannot rely on paper profits to pay its bills—those bills need to be paid in cash readily in hand. Say a company has accumulated $1 million in cash due to its previous Net Working Capital Definition years’ retained earnings. If the company were to invest all $1 million at once, it could find itself with insufficient current assets to pay for its current liabilities. This reflects the fact that it factors in current assets and current liabilities, which are generally defined as being able to be converted into cash within a year.

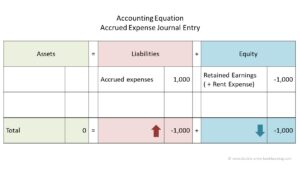

For example, interest on short-term and long-term loans taken to finance such current assets. Pvt Ltd has the following current assets and liabilities on its balance sheet dated 31st December 2019. Further, your Net Working Capital can either be positive or negative. Your business would have a positive Net Working Capital when its current assets would exceed its current liabilities. However, it would have a negative Net Working Capital if its current liabilities would exceed its current assets.

What is cash accounting?

Securities products and Payments services offered through Acquiom Financial LLC, an affiliate broker-dealer of SRS Acquiom Inc. and member FINRA/SIPC. Acquiom Financial does not make recommendations, provide investment advice, or determine the suitability of any security for any particular person or entity. Prior to that, he was an attorney in the Chicago office of Latham & Watkins, and in the Colorado office of Cooley LLP. After understanding the definition and the formula to derive your company’s net working capital, how about we give you an example for better understanding? We will be drilling down to each of the elements that help us calculate net working capital of a company.

Use the historical data to calculate drivers and assumptions for future periods. See the information below for common drivers used in calculating specific line items. Finally, use the prepared drivers and assumptions to calculate future values for the line items. At the end of 2021, Microsoft reported $174.2 billion of current assets.

Leave a Reply